2022 tax brackets

Working holiday maker tax rates 202223. A tax bracket is a range of incomes subject to a certain tax rate which is determined by your filing status and taxable income for the year.

Budget Highlights For 2021 22 Nexia Sab T

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

. Tax on this income. Each of the tax brackets income ranges jumped about 7 from last years numbers. 2021 federal income tax brackets for taxes due in April 2022 or in October 2022.

1 Married Individuals Filing Joint Returns. 10 announced new tax brackets for the 2022 tax year for taxes youll file in April 2023 or October 2023 if you file an extension. 2022 tax brackets are here.

For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and ends at 89075. Your 2021 Tax Bracket To See Whats Been Adjusted. 12 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000.

The minimum combined 2022 sales tax rate for Piscataway New Jersey is. The income brackets though are adjusted slightly for inflation. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year 2022 due April 15 2023.

Heres what filers need to know. What is the sales tax rate in Piscataway New Jersey. These are the 2021 brackets.

Up from 25900 in 2022. The County sales tax rate is. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

53325 plus 45 cents for. This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax rates was due in April 2022. The federal income tax rates for 2022 did not change from 2021.

Moving to a higher. Discover Helpful Information And Resources On Taxes From AARP. There are seven tax brackets for most ordinary.

31125 plus 37 cents for each 1 over 120000. 17 hours agoThe IRS has released higher federal tax brackets and standard deductions for 2023 to adjust for inflation. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts.

How the brackets work. 15 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. Federal Income Tax Brackets for 2022 Tax Season.

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. Please understand though that other governing authorities such as. The agency says that the Earned Income Tax Credit which.

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of 12570. Heres a breakdown of last years income and rates. In the American tax system income tax rates are graduated so you pay different rates on different amounts of taxable income called tax brackets.

The current tax year is from 6 April 2022 to 5 April 2023. The 2022 tax brackets affect the taxes that will be filed in 2023. The New Jersey sales tax rate is currently.

Whether you are single a head of household married etc. Tax brackets and rates for the 2022 tax year as well as for 2020 and previous years are elsewhere on this page. 11 hours ago2022 tax brackets for individuals.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered in 2018 by 128 percent. The Internal Revenue Service IRS makes adjustments every year and has.

You can work with a financial advisor who specializes in taxes to craft a. Single filers may claim. Federal income tax brackets were last changed one year ago for.

From 6935 for the 2022 tax year to 7430 in 2023. There are seven tax brackets in all. Income Tax rates and bands.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you. 189 of home value.

1 day agoTax agency wants to avoid bracket creep or when workers get pushed into higher tax brackets due to inflation. Up from 6935 for tax year 2022. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate.

The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. The IRS on Nov. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

The more you make the more you pay. Ad Compare Your 2022 Tax Bracket vs. The seven tax rates remain unchanged while the income limits have been adjusted for inflation.

Working holiday maker tax rates 202223. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with. Steffen noted that a married couple earning 200000 in both 2022 and 2023.

There are seven federal income tax rates in 2022. Download the free 2022 tax bracket pdf. And the alternative minimum tax exemption amount for next year will be 81200.

This is the total of state county and city sales tax rates. Tax amount varies by county. Americas tax brackets are changing thanks to inflation.

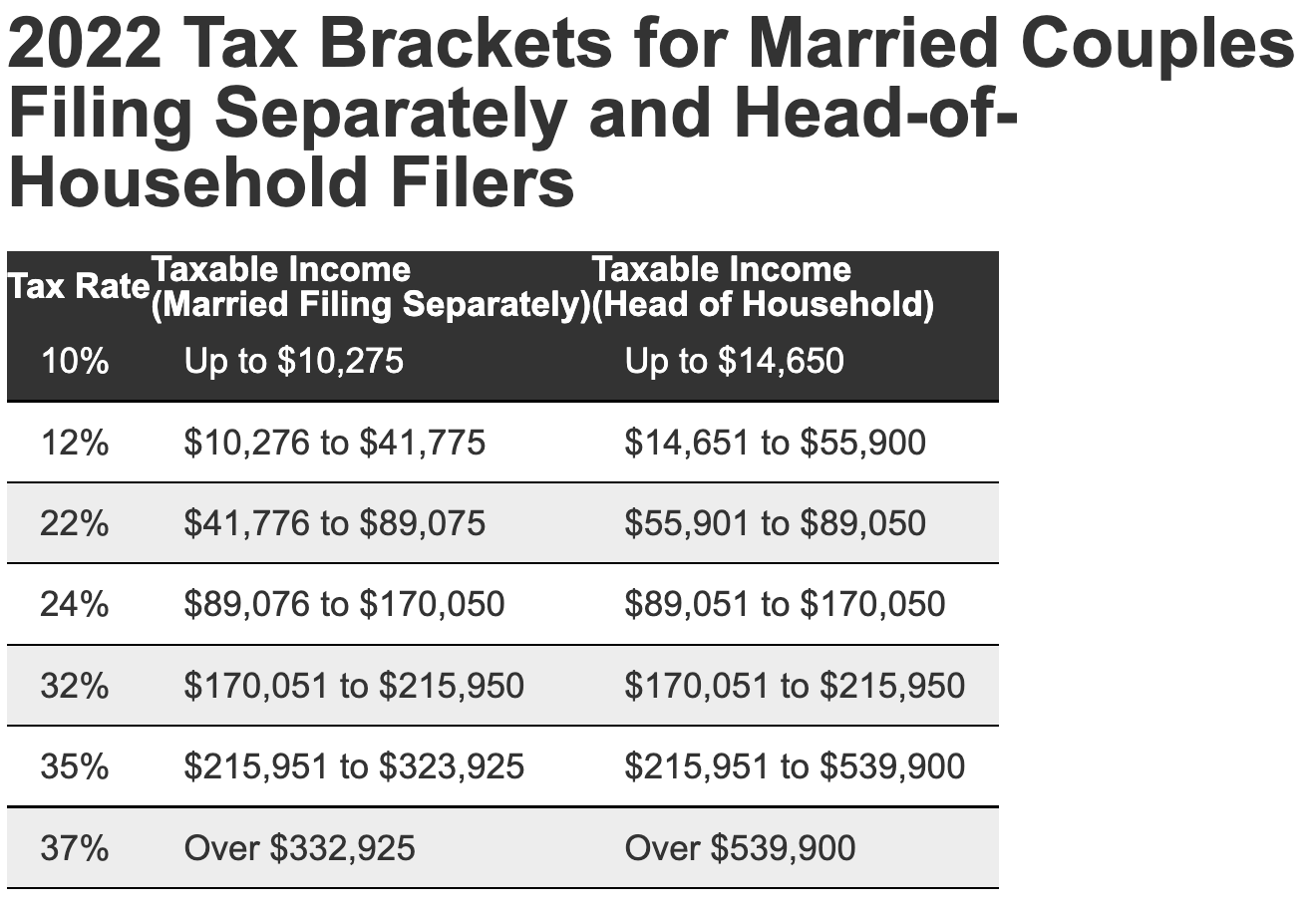

However for head-of-household filers it goes from 55901 to 89050.

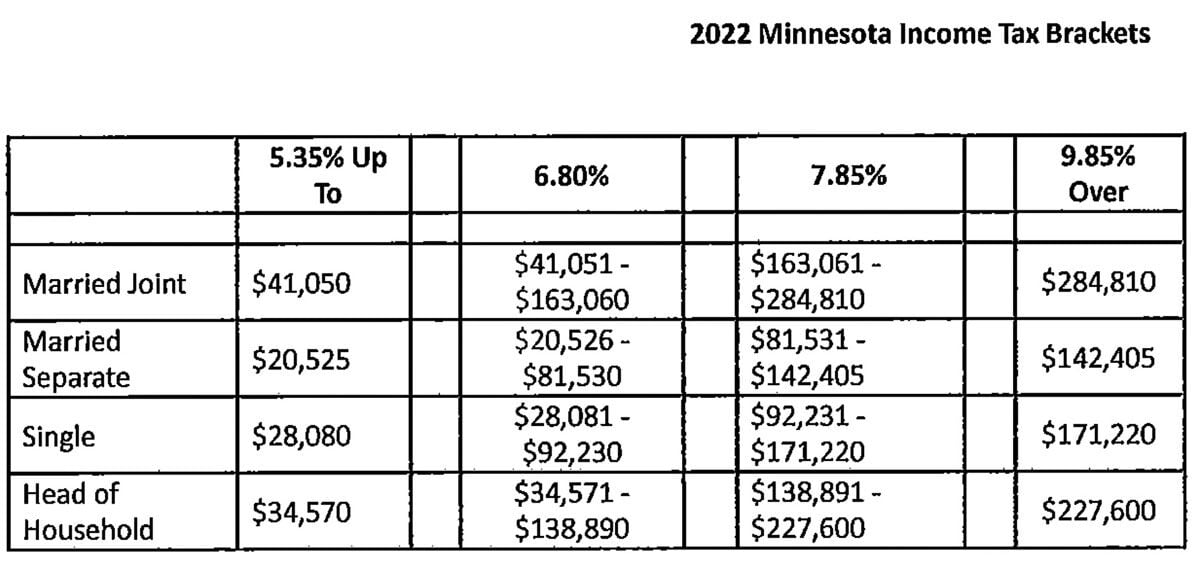

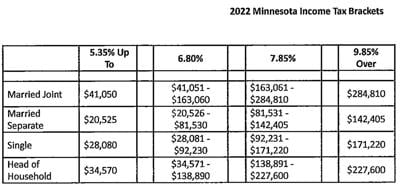

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

What Are The Income Tax Brackets For 2022 Vs 2021

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Understanding Marginal Income Tax Brackets Gentz Financial Services

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Miller Kaplan

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

Tax Brackets For 2021 And 2022 Ameriprise Financial

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

March 4 2022 2022 Small Business Tax Brackets Explained Gusto

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor